In the Arlington, Dallas and Fort Worth areas new property tax appraisal values for the current year are established in May. Property value notices are sent out to property owners on the 1st or 2nd of May. You can also look online at the appraised value set by your tax appraisal district by visiting their websites: Tarrant County Appraisal District & Dallas County Appraisal District

You may protest the value on your property in the following situations:

- the value the appraisal district placed on your property is too high

- your property is unequally appraised

- the appraisal district denied a special appraisal, such as open-space land, or incorrectly denied your exemption application

- the appraisal district failed to provide you required notices

- other matters prescribed by Tax Code Section 41.41(a)

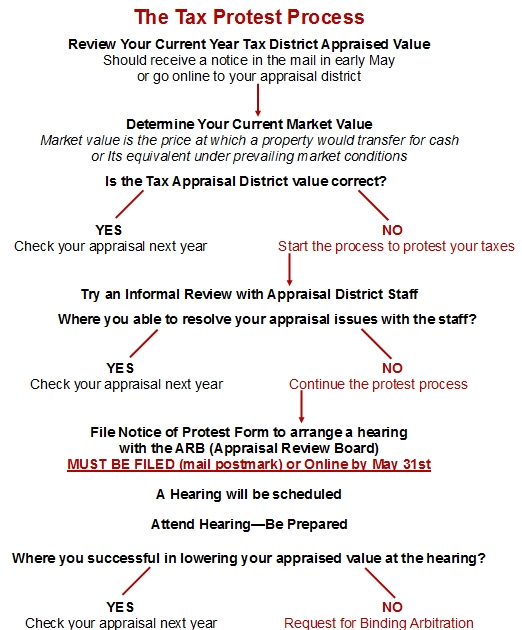

Many districts will informally review your concerns and may try to resolve our objections without a formal hearing. It is important, even if you think you may resolve your concerns at the informal meeting, to preserve your right to protest by filing your Notice of Protest before the May 31st deadline. Once your protest is received, the Appraisal Review Board (ARB) will notify you at least 15 days in advance of the date, time and place of your hearing. You can appear in person, by affidavit or through an agent. If you fail to appear, you may lose the right to be heard by the ARB on the protest and the right to appeal. Be on time for your hearing and come prepared. Present your information in a simple and organized manner. Photographs and other documents may be helpful. Take an appropriate number of copies so that each member of the ARB will receive one. After the hearing, the ARB will send their decision to you via certified mail. If you disagree with the ARB’s decision, you have the right to appeal. More information about the appeals process can be found at http://comptroller.texas.gov/taxinfo/proptax/protests.html. Here is a chart that outlines the steps to protest your property value:  If you need help determining your property value, call Ingrid or John Sullivan at 817-330-9235 for a complimentary comparative market analysis. More helpful links: Tarrant County Appraisal District Review Board Hearing Procedures Tarrant County Appraisal Review Board Notice of Protest Dallas County Appraisal District Protest Information

If you need help determining your property value, call Ingrid or John Sullivan at 817-330-9235 for a complimentary comparative market analysis. More helpful links: Tarrant County Appraisal District Review Board Hearing Procedures Tarrant County Appraisal Review Board Notice of Protest Dallas County Appraisal District Protest Information